|

|

|

|

| [VN

Boards Archive] |

Welcome to the Vault Network

forum archive.

This is not a complete archive, time didn't allot us the

opportunity to properly backup the majority of the boards

deemed "expendable". Most boards on this list have at least

20-40 pages archived (non-logged in pages, 15 topics per

page).

Popular boards may have as many as 250 pages archived at 50

topics per page, while others deemed of historical

signifigance may be archived in their entirety.

We may not agree with how the board shutdown was managed, but

we've done what we could to preserve some of its history in

lieu of that.

Please enjoy the archive.

~

Managers, Moderators, VIP's, and regular posters.

|

| Author |

Topic: Weekly initial jobless claims down 13,000 to 348,000

|

Abaddon_Ambrosius

Title: Retired Theurgist TL

Posts:

25,187

Registered:

Dec 21, '01

Extended Info (if available)

Real Post Cnt: 25,057

User ID: 568,022

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

So, we're just barely bumping along at that "healing" number -- somewhere less than 350,000 -- that slightly outstrips normal job turnover and attrition.

The 4 week moving average is down about 1,400 to 365,000. At minimum, that needs to get below 350,000 and stay there.

Producer Price Index is up .1%.

I don't bother to report unemployment # because, as we discussed ad nauseum, it doesn't mean anything. Official U6 number of unemployed & underemployed seeking gainful employment is still in the 14.5 -> 15% range.

-----signature-----

In the immortal words of Socrates - "I drank what?"

"God you guys suck at the internet - how can you fail to locate porn?!" - Eternal_Midnight

"Knowing means nothing." - Fat-badger

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

|

There are some wicked, wicked headwinds on the horizon. We should take whatever good news comes our way now and feel good about it.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Thugoneous

Title: Watching Caliente, BRB.

Posts:

6,060

Registered:

Nov 2, '02

Extended Info (if available)

Real Post Cnt: 5,795

User ID: 734,292

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

|

Foreclosures are up 8%

-----signature-----

Lady, people aren't chocolates. D'you know what they are mostly? Bastards. Bastard-coated bastards with bastard filling.

|

|

Link to this post

|

Sin_of_Onin

Posts:

35,113

Registered:

Jun 29, '05

Extended Info (if available)

Real Post Cnt: 23,763

User ID: 1,062,657

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Rosaria posted:

There are some wicked, wicked headwinds on the horizon.

Are you just going to leave that hanging?

-----signature-----

"Okay... I'm with you fellas" --Delmar

F is for Fake-believe

"We apologise for the inconvenience" --God

"What Jesus fails to appreciate is that it's the meek who are the problem"--Reg

Run, Forrest! Run!

|

|

Link to this post

|

Abaddon_Ambrosius

Title: Retired Theurgist TL

Posts:

25,187

Registered:

Dec 21, '01

Extended Info (if available)

Real Post Cnt: 25,057

User ID: 568,022

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Thugoneous posted:

Foreclosures are up 8%

They'll go higher. The robosigning thing is over, the banks are freed up to move on people. I read a stat somewhere that we're now at the highest % on record for people 1-year delinquent or more.

About to get ugly. Rental market is about to get crowded.

-----signature-----

In the immortal words of Socrates - "I drank what?"

"God you guys suck at the internet - how can you fail to locate porn?!" - Eternal_Midnight

"Knowing means nothing." - Fat-badger

|

|

Link to this post

|

Thugoneous

Title: Watching Caliente, BRB.

Posts:

6,060

Registered:

Nov 2, '02

Extended Info (if available)

Real Post Cnt: 5,795

User ID: 734,292

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

|

So should I raise my rent this year on my tenants?

-----signature-----

Lady, people aren't chocolates. D'you know what they are mostly? Bastards. Bastard-coated bastards with bastard filling.

|

|

Link to this post

|

Abaddon_Ambrosius

Title: Retired Theurgist TL

Posts:

25,187

Registered:

Dec 21, '01

Extended Info (if available)

Real Post Cnt: 25,057

User ID: 568,022

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Thugoneous posted:

So should I raise my rent this year on my tenants?

It's specific to zip code, really, so you are apples to apples.

Rents in several zip codes around me shot up about 8-10% this last year. I hiked my rent on a nice condo a scant 5% and filled the place in 6 days.

I'm having to raise the rents though because inflation is setting in, driving up the association/maintenance fees.

PS: I got no idea if you really have tenants or not. I do.

-----signature-----

In the immortal words of Socrates - "I drank what?"

"God you guys suck at the internet - how can you fail to locate porn?!" - Eternal_Midnight

"Knowing means nothing." - Fat-badger

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Sin_of_Onin posted:

Rosaria posted:

There are some wicked, wicked headwinds on the horizon.

Are you just going to leave that hanging?

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Sin_of_Onin

Posts:

35,113

Registered:

Jun 29, '05

Extended Info (if available)

Real Post Cnt: 23,763

User ID: 1,062,657

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Rosa, are you going to actually say something of your own or are you just going to imply things and refer to articles?

-----signature-----

"Okay... I'm with you fellas" --Delmar

F is for Fake-believe

"We apologise for the inconvenience" --God

"What Jesus fails to appreciate is that it's the meek who are the problem"--Reg

Run, Forrest! Run!

|

|

Link to this post

|

Sansfear

Posts:

7,232

Registered:

Aug 31, '08

Extended Info (if available)

Real Post Cnt: 7,182

User ID: 1,318,423

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

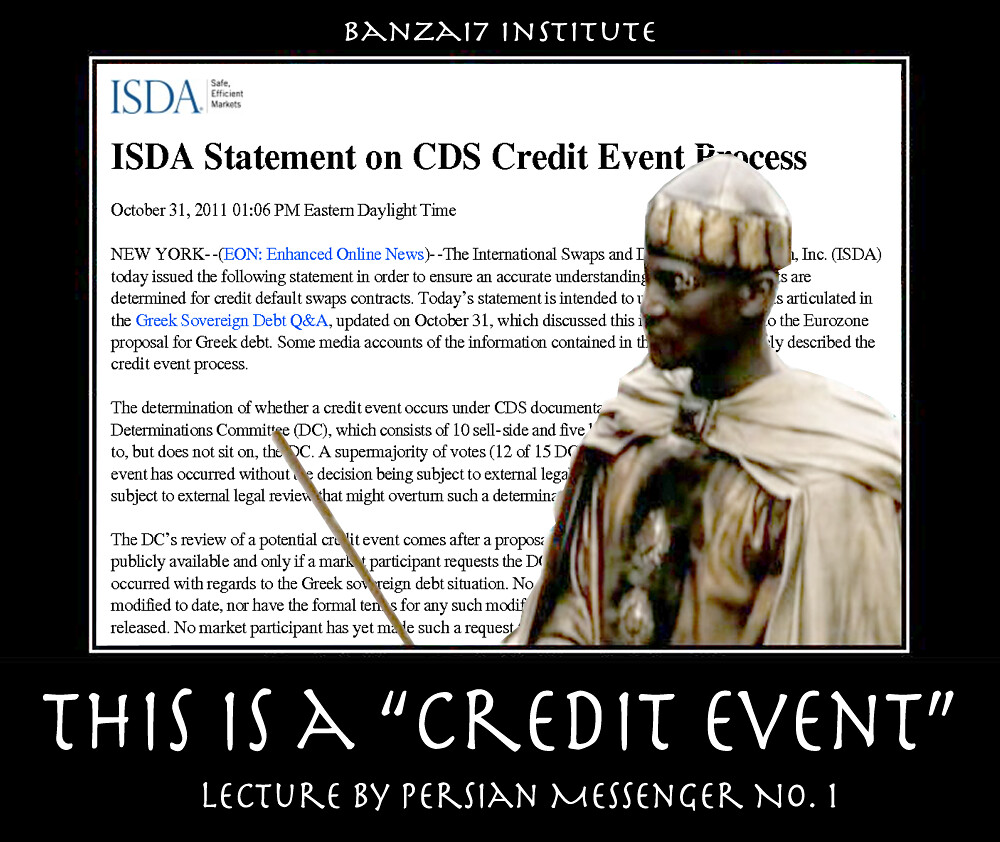

I think she's talking about if/when and whether or not the Greek economy officially defaults which would activate all the credit default swaps tied to it.

They keep throwing money at them in an attempt to avoid that happening, but it is inevitably going to do so (and should have been done awhile back so they could restructure). All they are doing now is throwing hundreds of billions of good money after bad.

Then again, I could be wrong!

-----signature-----

(none)

|

|

Link to this post

|

ZigmundZag

Title: Grammar Nazi

Posts:

25,948

Registered:

Mar 25, '02

Extended Info (if available)

Real Post Cnt: 22,707

User ID: 661,552

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Sansfear posted:

I think she's talking about if/when and whether or not the Greek economy officially defaults which would activate all the credit default swaps tied to it.

They keep throwing money at them in an attempt to avoid that happening, but it is inevitably going to do so (and should have been done awhile back so they could restructure). All they are doing now is throwing hundreds of billions of good money after bad.

Then again, I could be wrong!

There's a growing sense that you're not wrong...in fact "throwing good money after bad" is exactly the phrase I heard used to reference their last meeting/conference call/whatever on the subject.

-----signature-----

"Take the cheese to sickbay!"

|

|

Link to this post

|

Sin_of_Onin

Posts:

35,113

Registered:

Jun 29, '05

Extended Info (if available)

Real Post Cnt: 23,763

User ID: 1,062,657

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Sansfear posted:

I think she's talking about if/when and whether or not the Greek economy officially defaults which would activate all the credit default swaps tied to it.

They keep throwing money at them in an attempt to avoid that happening, but it is inevitably going to do so (and should have been done awhile back so they could restructure). All they are doing now is throwing hundreds of billions of good money after bad.

Then again, I could be wrong!

It is not exactly a secret that the Greek mess could explode even further and that will impact the US. I am not sure what she was trying to say beyond simply pointing to one of the most popular economic stories over the past year.

-----signature-----

"Okay... I'm with you fellas" --Delmar

F is for Fake-believe

"We apologise for the inconvenience" --God

"What Jesus fails to appreciate is that it's the meek who are the problem"--Reg

Run, Forrest! Run!

|

|

Link to this post

|

Voodoo-Dahl

Posts:

14,875

Registered:

May 11, '02

Extended Info (if available)

Real Post Cnt: 13,135

User ID: 677,792

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

The nutters at WNDHedge have been prophesying our economic destruction for three years now. You never know, if they keep it up, they may accidentally be right eventually.

I lump them in with the war with Iran crowd.

-----signature-----

(none)

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Sorry, just got back and am typing this with an eye patch on, so please excuse typos and the occasional burst of Tourette's.

There's a squillion words already printed about Greece but overall I think its a mistake to just say its a case of throwing good money after bad, because the money being spent on Greece is not going to the Greek people, its being diluted across hundreds of international banks and its 'their' money that is magically being guaranteed, not the welfare of the Greek people. This has nothing to do with people because in the final analysis no one gives a shit about Greece. This is about Greek bond swaps that in effect will have the ECB paying far far more than the initial cost of the bond issuance to begin with. Its going to be voted on before anyone even knows if Greece has complied, or has any intention of complying with, the restructuring provisos or not. No one cares, its the shifting of money that matters. Greece has not even made the debt swap offer, and can, after making the offer, withdraw it at any time!

To answer Sin directly, I do not believe there is an LTRO nor a Fed discount window large enough to support international banks who have dreadful risk exposure not only to Greece, but to Spain, Italy, and Portugal in that order. Greece is just one tiny example or portend of four other disasters with abysmally high employment waiting for their turn whose impact is far greater on the overal EU economy.

I simply do not believe any of this action is sustainable, and its going to impact the US in waves because there are no firewalls in place to protect US interests from the financial drama I believe will take place over the next several months. The Mother of All Credit Events is unfolding before us and its infantile to presume that its all because of those 'fatuous and selfish' Greek people.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Abaddon_Ambrosius

Title: Retired Theurgist TL

Posts:

25,187

Registered:

Dec 21, '01

Extended Info (if available)

Real Post Cnt: 25,057

User ID: 568,022

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Rosaria posted:

Sorry, just got back and am typing this with an eye patch on, so please excuse typos and the occasional burst of Tourette's.

-----signature-----

In the immortal words of Socrates - "I drank what?"

"God you guys suck at the internet - how can you fail to locate porn?!" - Eternal_Midnight

"Knowing means nothing." - Fat-badger

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Abaddon_Ambrosius posted:

Rosaria posted:

Sorry, just got back and am typing this with an eye patch on, so please excuse typos and the occasional burst of Tourette's.

Fu...fuck..kkk fuck you.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

imaloon1

Posts:

25,153

Registered:

Sep 15, '03

Extended Info (if available)

Real Post Cnt: 19,758

User ID: 838,293

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Rosaria posted:

Abaddon_Ambrosius posted:

Rosaria posted:

Sorry, just got back and am typing this with an eye patch on, so please excuse typos and the occasional burst of Tourette's.

Fu...fuck..kkk fuck you.

LMAO.... I have no idea why you're cussing him but I think it's funny anyway.

-----signature-----

The time draws nearer to your fate

|

|

Link to this post

|

Sin_of_Onin

Posts:

35,113

Registered:

Jun 29, '05

Extended Info (if available)

Real Post Cnt: 23,763

User ID: 1,062,657

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Rosaria posted:

Sorry, just got back and am typing this with an eye patch on, so please excuse typos and the occasional burst of Tourette's.

There's a squillion words already printed about Greece but overall I think its a mistake to just say its a case of throwing good money after bad, because the money being spent on Greece is not going to the Greek people, its being diluted across hundreds of international banks and its 'their' money that is magically being guaranteed, not the welfare of the Greek people. This has nothing to do with people because in the final analysis no one gives a shit about Greece. This is about Greek bond swaps that in effect will have the ECB paying far far more than the initial cost of the bond issuance to begin with. Its going to be voted on before anyone even knows if Greece has complied, or has any intention of complying with, the restructuring provisos or not. No one cares, its the shifting of money that matters. Greece has not even made the debt swap offer, and can, after making the offer, withdraw it at any time!

To answer Sin directly, I do not believe there is an LTRO nor a Fed discount window large enough to support international banks who have dreadful risk exposure not only to Greece, but to Spain, Italy, and Portugal in that order. Greece is just one tiny example or portend of four other disasters with abysmally high employment waiting for their turn whose impact is far greater on the overal EU economy.

I simply do not believe any of this action is sustainable, and its going to impact the US in waves because there are no firewalls in place to protect US interests from the financial drama I believe will take place over the next several months. The Mother of All Credit Events is unfolding before us and its infantile to presume that its all because of those 'fatuous and selfish' Greek people.

I thought the whole point of the massive amount of CDS was to bet against Greece. In fact the amount of CDS outstanding seem to suggest that the market is less about insurance and more about high stakes gambling.

At this point it is like everyone is just waiting for the implosion to occur and spread. Those who have risk exposure have had plenty of time to address that risk which should help.

The US is exposed to the European crisis but not to the same degree Europe is exposed to our own economic hardships.

/shrug

-----signature-----

"Okay... I'm with you fellas" --Delmar

F is for Fake-believe

"We apologise for the inconvenience" --God

"What Jesus fails to appreciate is that it's the meek who are the problem"--Reg

Run, Forrest! Run!

|

|

Link to this post

|

Abaddon_Ambrosius

Title: Retired Theurgist TL

Posts:

25,187

Registered:

Dec 21, '01

Extended Info (if available)

Real Post Cnt: 25,057

User ID: 568,022

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

imaloon1 posted:

Rosaria posted:

Fu...fuck..kkk fuck you.

LMAO.... I have no idea why you're cussing him but I think it's funny anyway.

LOL she's just adding the Tourette's since I was remiss and only provided the eye patch.

I get Rosie better than I probably should, sometimes.

-----signature-----

In the immortal words of Socrates - "I drank what?"

"God you guys suck at the internet - how can you fail to locate porn?!" - Eternal_Midnight

"Knowing means nothing." - Fat-badger

|

|

Link to this post

|

Z-Elder

Posts:

8,621

Registered:

Mar 15, '02

Extended Info (if available)

Real Post Cnt: 8,465

User ID: 657,803

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Sin_of_Onin posted:

Rosaria posted:

Sorry, just got back and am typing this with an eye patch on, so please excuse typos and the occasional burst of Tourette's.

There's a squillion words already printed about Greece but overall I think its a mistake to just say its a case of throwing good money after bad, because the money being spent on Greece is not going to the Greek people, its being diluted across hundreds of international banks and its 'their' money that is magically being guaranteed, not the welfare of the Greek people. This has nothing to do with people because in the final analysis no one gives a shit about Greece. This is about Greek bond swaps that in effect will have the ECB paying far far more than the initial cost of the bond issuance to begin with. Its going to be voted on before anyone even knows if Greece has complied, or has any intention of complying with, the restructuring provisos or not. No one cares, its the shifting of money that matters. Greece has not even made the debt swap offer, and can, after making the offer, withdraw it at any time!

To answer Sin directly, I do not believe there is an LTRO nor a Fed discount window large enough to support international banks who have dreadful risk exposure not only to Greece, but to Spain, Italy, and Portugal in that order. Greece is just one tiny example or portend of four other disasters with abysmally high employment waiting for their turn whose impact is far greater on the overal EU economy.

I simply do not believe any of this action is sustainable, and its going to impact the US in waves because there are no firewalls in place to protect US interests from the financial drama I believe will take place over the next several months. The Mother of All Credit Events is unfolding before us and its infantile to presume that its all because of those 'fatuous and selfish' Greek people.

I thought the whole point of the massive amount of CDS was to bet against Greece. In fact the amount of CDS outstanding seem to suggest that the market is less about insurance and more about high stakes gambling.

At this point it is like everyone is just waiting for the implosion to occur and spread. Those who have risk exposure have had plenty of time to address that risk which should help.

The US is exposed to the European crisis but not to the same degree Europe is exposed to our own economic hardships.

/shrug

That is how I have been looking at all these messes. It appears all they have done is spread a depression out over time. There is no saving of anyones butt. There is only time for many large players to soften their landings. Yet one has to wonder what would have happened if the world had not embraced "too big to fail".

-----signature-----

"The poison of our ordinary habits has killed the magic of the moment"

"Men are not in hell because God is angry with them . . .

they stand in the state of division and separation which by their own motion, they have made for themselves"

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Sin_of_Onin posted:

Rosaria posted:

Sorry, just got back and am typing this with an eye patch on, so please excuse typos and the occasional burst of Tourette's.

There's a squillion words already printed about Greece but overall I think its a mistake to just say its a case of throwing good money after bad, because the money being spent on Greece is not going to the Greek people, its being diluted across hundreds of international banks and its 'their' money that is magically being guaranteed, not the welfare of the Greek people. This has nothing to do with people because in the final analysis no one gives a shit about Greece. This is about Greek bond swaps that in effect will have the ECB paying far far more than the initial cost of the bond issuance to begin with. Its going to be voted on before anyone even knows if Greece has complied, or has any intention of complying with, the restructuring provisos or not. No one cares, its the shifting of money that matters. Greece has not even made the debt swap offer, and can, after making the offer, withdraw it at any time!

To answer Sin directly, I do not believe there is an LTRO nor a Fed discount window large enough to support international banks who have dreadful risk exposure not only to Greece, but to Spain, Italy, and Portugal in that order. Greece is just one tiny example or portend of four other disasters with abysmally high employment waiting for their turn whose impact is far greater on the overall EU economy.

I simply do not believe any of this action is sustainable, and its going to impact the US in waves because there are no firewalls in place to protect US interests from the financial drama I believe will take place over the next several months. The Mother of All Credit Events is unfolding before us and its infantile to presume that its all because of those 'fatuous and selfish' Greek people.

I thought the whole point of the massive amount of CDS was to bet against Greece. In fact the amount of CDS outstanding seem to suggest that the market is less about insurance and more about high stakes gambling.

At this point it is like everyone is just waiting for the implosion to occur and spread. Those who have risk exposure have had plenty of time to address that risk which should help.

The US is exposed to the European crisis but not to the same degree Europe is exposed to our own economic hardships.

/shrug

Its all about high stakes gambling. You are exactly right including sovereign bonds and otherwise, purchasing of public debt by private banks, etc with the appearance of risk management or assurance being offered by entities that simply cannot provide it. I don't believe at any time this was about the welfare of the Greek people nor the welfare of the Greek economy, but rather Greece provided the venue and has been an unwilling participant throughout it. Germany is being identified as the financial aggressor but Germany's economy contracted last quarter, and if it does so again, will signal its inability to further prop up an EU economy that is going to receive further shock waves in the form of the aforementioned countries. In order for the US to proceed with economic gains it has made it must have a functioning and strong EU. You probably think otherwise. Its not going to get that, I fear. The coupling of the USD and EURO has also not helped.

I don't know what's going to happen to the EURO if Greece defaults, which I think it will. That's going to be another shock wave through the currency markets. I agree there has been plenty of time to make necessary arrangements in the event of a Greek default. I don't have a lot of faith though that those were made to the degree they will be needed. There has been significant obfuscation of the entire process that has led to enormous amounts of money changing hands with the belief that Greece would succeed. I am speaking of an 'all in" attitude that has permeated international banking which speaks well to your statement about high stakes gambling. Major large EU banks have tremendously high exposure and also have strong ties to the international operations of US banks.

I also agree that US exposure to a EU crisis does not equal EU exposure to a US crisis in degree of impact. What I do think is in the event of a Greek default there will be a strong negative feedback loop that will perpetuate any risks that do arise. Yes, I speak of financial institutions like Goldman Sachs but I have to admit I am strongly negatively biased against them so take that with a grain of salt.

Anyway, that is one of the wicked headwinds I was referring to. There are others like global commmodities prices, oil, possible war with Iran, trade wars with China, etc. that have the potential to be at the very least unsettling. Coupled with our own structural difficulties, I am not as optimistic as most of our MSM and general public seem to be. I'm hoping very much that I'm wrong but planning as if I'm right.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Abaddon_Ambrosius posted:

imaloon1 posted:

Rosaria posted:

Fu...fuck..kkk fuck you.

LMAO.... I have no idea why you're cussing him but I think it's funny anyway.

LOL she's just adding the Tourette's since I was remiss and only provided the eye patch.

I get Rosie better than I probably should, sometimes.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Groucho48

Posts:

11,206

Registered:

Oct 22, '03

Extended Info (if available)

Real Post Cnt: 11,136

User ID: 847,611

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

I'll state right up front that the situation in Europe is far too complex and technical fro me to grasp.

I do have a question. How big a haircut are the financial institutions taking?

-----signature-----

“Science is like sex: sometimes something useful comes out, but that is not the reason we are doing it.†– Richard Feynman

|

|

Link to this post

|

Remnant_OBrien

Posts:

14,440

Registered:

May 11, '03

Extended Info (if available)

Real Post Cnt: 13,108

User ID: 801,003

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Sin_of_Onin posted:

Rosaria posted:

There are some wicked, wicked headwinds on the horizon.

Are you just going to leave that hanging?

Isn't that how Rosaria rolls? Make some cryptic bullshit statement that could mean anything. Pretend to be intelligent. 69 with AA over how smart both of them think they are.

-----signature-----

The People's Intern

"If I had a plan to kill liberals the liberals would not know about it. Until it is too late of course. I have no such plan, sleep well, sleep deeply." -Fisted

LOTRO: Windfola - Telpehta

|

|

Link to this post

|

__Bonk__

Posts:

53,947

Registered:

Jul 25, '09

Extended Info (if available)

Real Post Cnt: 53,339

User ID: 1,364,654

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

So says her stalker

-----signature-----

I keep my eyes fixed on the sun!

A change in feeling is a change in destiny.

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

|

Stupid fucking asshole stalker Redundant is incapable of reading the rest of the thread because he doesn't understand it.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Groucho48 posted:

I'll state right up front that the situation in Europe is far too complex and technical fro me to grasp.

I do have a question. How big a haircut are the financial institutions taking?

Is that a joke question?

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Sin_of_Onin

Posts:

35,113

Registered:

Jun 29, '05

Extended Info (if available)

Real Post Cnt: 23,763

User ID: 1,062,657

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

When I say high stakes gambling I mean people investing in CDS that are not doing it to counter their exposure to some underlying bond. Ie, if you own Greek bonds you could buy a CDS which lowers your return while lowering your risk. You can also just bet that Greece will default without holding the underlying debt. In the first case it is basically just insurance, in the second it is gambling.

I think only the banks know how much they have to lose in the various scenarios but as I already pointed out they won’t be caught off guard and will have made moves to protect themselves months ago. Those moves can end up killing other companies though. Happened to AIG.

China will continue to move slowly towards reducing their monetary manipulation IMO but politics in both countries will prevent major changes from happening until after the Presidential election.

There are always concerns but at least the US is starting to get back on its feet. It can get knocked back down but I think the world economy is finally starting to realize just how stupid imbalanced capital flows are.

-----signature-----

"Okay... I'm with you fellas" --Delmar

F is for Fake-believe

"We apologise for the inconvenience" --God

"What Jesus fails to appreciate is that it's the meek who are the problem"--Reg

Run, Forrest! Run!

|

|

Link to this post

|

Groucho48

Posts:

11,206

Registered:

Oct 22, '03

Extended Info (if available)

Real Post Cnt: 11,136

User ID: 847,611

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Rosaria posted:

Groucho48 posted:

I'll state right up front that the situation in Europe is far too complex and technical fro me to grasp.

I do have a question. How big a haircut are the financial institutions taking?

Is that a joke question?

No. Everyone is calling for austerity for UK, for Ireland, for Spain, for Greece, so that the banks can be paid back. S, the natural question is...do the financial institutions who made the stupid loans suffer any consequences?

-----signature-----

“Science is like sex: sometimes something useful comes out, but that is not the reason we are doing it.†– Richard Feynman

|

|

Link to this post

|

Abaddon_Ambrosius

Title: Retired Theurgist TL

Posts:

25,187

Registered:

Dec 21, '01

Extended Info (if available)

Real Post Cnt: 25,057

User ID: 568,022

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

@Groucho I haven't paid attention the last 3 weeks but the last deal I heard rejected was: private institutions take a 70% haircut, or, stretch out their loans another 30-ish years with a 30-ish percent haircut.

Rosie may have more specifics. I took my eye off the ball there recently. Got tired of waiting to hear the rumor of the day. They won't arrive at anything real until end of Feb, earliest. Deadlines are around mid-March.

-----signature-----

In the immortal words of Socrates - "I drank what?"

"God you guys suck at the internet - how can you fail to locate porn?!" - Eternal_Midnight

"Knowing means nothing." - Fat-badger

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Sin_of_Onin posted:

When I say high stakes gambling I mean people investing in CDS that are not doing it to counter their exposure to some underlying bond. Ie, if you own Greek bonds you could buy a CDS which lowers your return while lowering your risk. You can also just bet that Greece will default without holding the underlying debt. In the first case it is basically just insurance, in the second it is gambling.

I think only the banks know how much they have to lose in the various scenarios but as I already pointed out they won’t be caught off guard and will have made moves to protect themselves months ago. Those moves can end up killing other companies though. Happened to AIG.

China will continue to move slowly towards reducing their monetary manipulation IMO but politics in both countries will prevent major changes from happening until after the Presidential election.

There are always concerns but at least the US is starting to get back on its feet. It can get knocked back down but I think the world economy is finally starting to realize just how stupid imbalanced capital flows are.

Its all gambling Sin because Greece has the option of denying or stopping the process once its begun yet significant amounts of money have already changed hands. It can do it one month, two months [I dont think this is going to last that long anyway], whatever. Do you think if there is another AIG scenario that there will be further public funds offered to assauge the loss? I absolutely agree that the US has made gains. I don't believe that the world has learned or realized any such thing about imbalanced capital flows because I don't see any evidence of that.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Groucho48 posted:

Rosaria posted:

Groucho48 posted:

I'll state right up front that the situation in Europe is far too complex and technical fro me to grasp.

I do have a question. How big a haircut are the financial institutions taking?

Is that a joke question?

No. Everyone is calling for austerity for UK, for Ireland, for Spain, for Greece, so that the banks can be paid back. S, the natural question is...do the financial institutions who made the stupid loans suffer any consequences?

There are potentially enormous losses for private institutions; they do have some options but they are going to lose in either event. In the case of Greece private institutions were 'incentivized' to go into the rescue package but whether or not the ECB is going to let those losses stand in the long run [ten to thirty years] is guesswork. What that potentially means for people with money in those banks is that they are also going to experience bank manipulations in order for the bank to survive, much as what we have seen in the US. Given that the EU never really crawled out of the recession and still has high unemployment that means credit will start crunching even moreso than it already is.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Sin_of_Onin

Posts:

35,113

Registered:

Jun 29, '05

Extended Info (if available)

Real Post Cnt: 23,763

User ID: 1,062,657

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Rosaria posted:

Its all gambling Sin because Greece has the option of denying or stopping the process once its begun yet significant amounts of money have already changed hands. It can do it one month, two months [I dont think this is going to last that long anyway], whatever. Do you think if there is another AIG scenario that there will be further public funds offered to assauge the loss? I absolutely agree that the US has made gains. I don't believe that the world has learned or realized any such thing about imbalanced capital flows because I don't see any evidence of that.

I'll address backwards...

The issue has even made wikipedia... I think there is decent evidence.

http://en.wikipedia.org/wiki/Balance_of_payments

Yes there will be some move by the European governments to try and deal with the fallout of the Greece mess.

Greece can walk away from those deals you are right. That is why default is still a possibility.

There will be a lot of pain but I think the US will continue to plod along.

-----signature-----

"Okay... I'm with you fellas" --Delmar

F is for Fake-believe

"We apologise for the inconvenience" --God

"What Jesus fails to appreciate is that it's the meek who are the problem"--Reg

Run, Forrest! Run!

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Abaddon_Ambrosius posted:

@Groucho I haven't paid attention the last 3 weeks but the last deal I heard rejected was: private institutions take a 70% haircut, or, stretch out their loans another 30-ish years with a 30-ish percent haircut.

Rosie may have more specifics. I took my eye off the ball there recently. Got tired of waiting to hear the rumor of the day. They won't arrive at anything real until end of Feb, earliest. Deadlines are around mid-March.

I think they have thirty days but this is the EU and that may get extended. We are talking about billions of EUROs at risk.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Rosaria

Title: They call me Mellow Yellow, quite rightly.

Posts:

46,983

Registered:

Aug 22, '03

Extended Info (if available)

Real Post Cnt: 44,486

User ID: 832,524

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Sin_of_Onin posted:

There will be a lot of pain but I think the US will continue to plod along.

I hope so, it has taken enormous effort and even some gambling on our part to get this far. Let me put it this way, I have more faith that the international banking community will enormously fuck up than I do that sovereigns will continually and effectively clean up their mess. This is not to say that sovereigns don't have their role in this as well. We are speaking of enormous losses by both sovereigns and private banking institutions. This is really going to test our firewalls.

-----signature-----

"Them Bollinger Bands on the DJIA are starting to look like columns of projectile vomit." ~ Red Pill

|

|

Link to this post

|

Groucho48

Posts:

11,206

Registered:

Oct 22, '03

Extended Info (if available)

Real Post Cnt: 11,136

User ID: 847,611

|

Subject:

Weekly initial jobless claims down 13,000 to 348,000

|

Abaddon_Ambrosius posted:

@Groucho I haven't paid attention the last 3 weeks but the last deal I heard rejected was: private institutions take a 70% haircut, or, stretch out their loans another 30-ish years with a 30-ish percent haircut.

Rosie may have more specifics. I took my eye off the ball there recently. Got tired of waiting to hear the rumor of the day. They won't arrive at anything real until end of Feb, earliest. Deadlines are around mid-March.

Thanks for the reply. So, they do have some skin in the game. Good to know. I would think the 30 year extension with a 30% haircut isn't too bad a deal for them, depending on interest rates and such. Probably a better deal than the citizens of the countries are getting.

-----signature-----

“Science is like sex: sometimes something useful comes out, but that is not the reason we are doing it.†– Richard Feynman

|

|

Link to this post

|

|

|

| © 2012. All

Rights Reserved. |

|

|

|

|